Escrow Agent

Escrow Agent

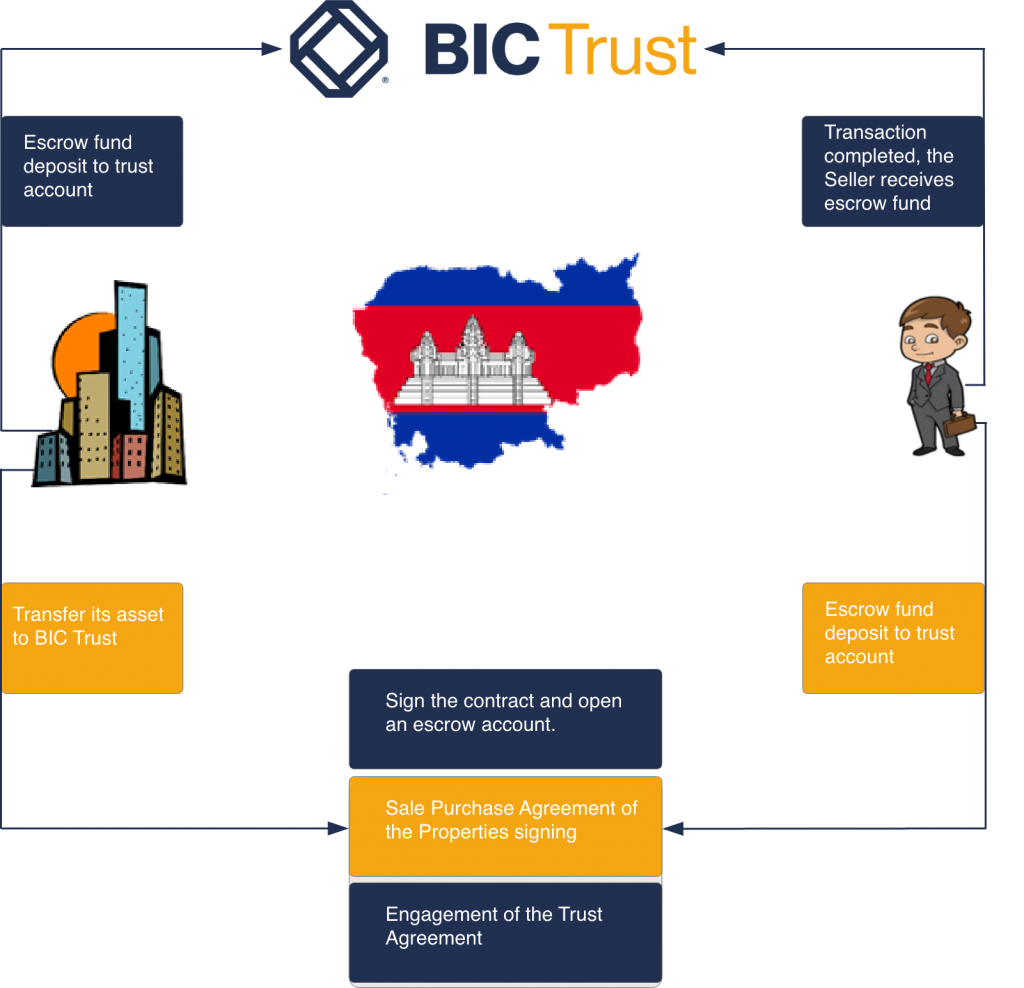

Trustee as an escrow agent assisting in holding funds, documents, property in trust for third parties until both parties have fulfilled their contractual requirements or they are transferred from one party to another. Appoint Trustee as escrow agent is an impartial and independent means from both the buyer and the seller in real estate on behalf of the contractor itself, making sure everything is followed before allowing the deal to proceed.

Case Study

An Indonesian company (‘the Company’) wants to purchase 1,000 hectares of land in Cambodia, but this Company cannot buy and hold the property hereto in Cambodia. This company chooses BIC Trust as an escrow agent to hold its funds by depositing the funds to the Trust Account until such time that the terms & conditions are met by the seller and company in order of Escrow Agreement. BIC Trust’s duties & fiduciary role is to both parties and will act according to the sale-purchase agreement of a property (SPA). At the closing of a real estate transaction, BIC Trust will transfer the funds from the Trust account to the seller as the deposit balance is fully paid and the buyer will receive the title deed of the property hereby.

The Indonesian company also appoints BIC trust as a Trustee, a legal representative holding its property.